Introduction

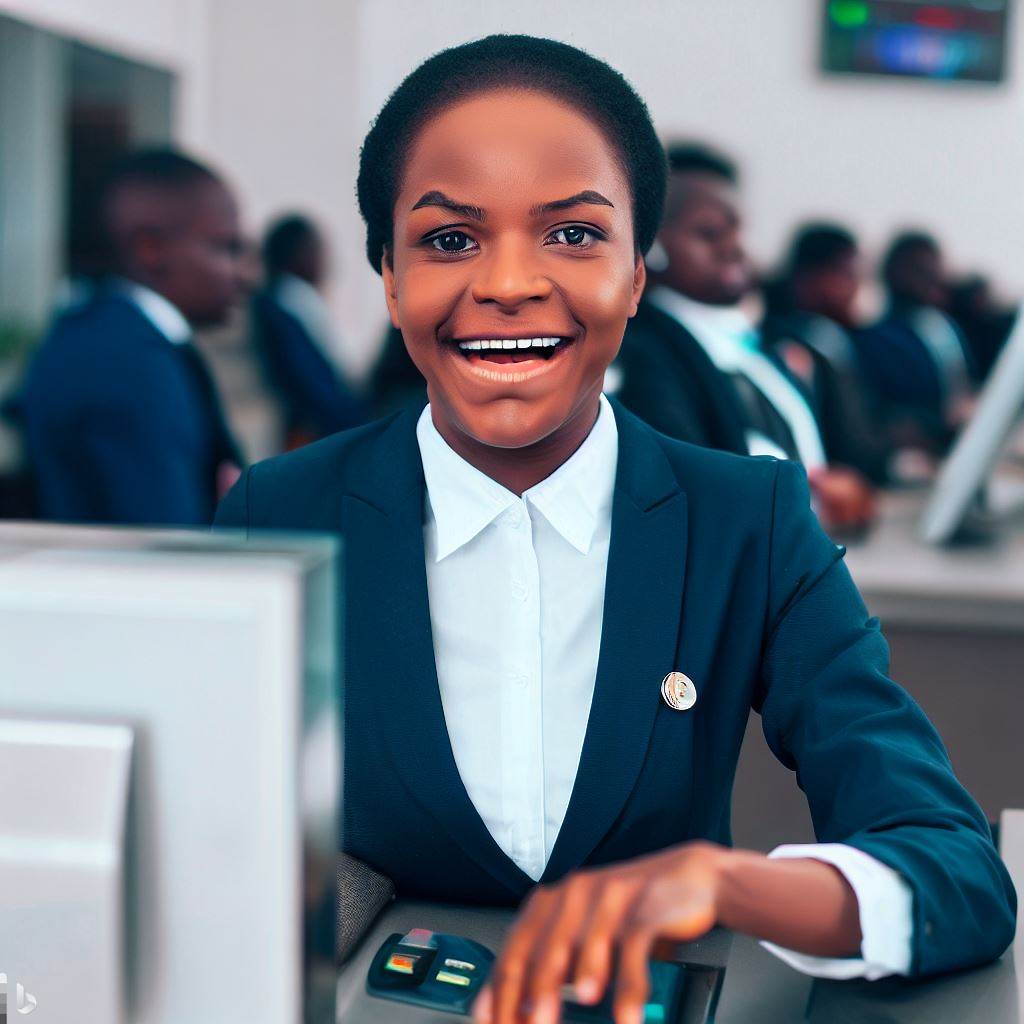

Teller opportunities play a crucial role in the Nigeria banks, facilitating financial transactions and providing excellent customer service.

With the growing importance of banking jobs, the demand for tellers is expected to rise significantly in the year 2023.

Nigeria’s banking industry is integral to the country’s economic growth, making teller opportunities essential.

Tellers are responsible for handling cash transactions, assisting customers with account inquiries, and promoting various banking services.

Their expertise ensures smooth banking operations and enhances customer satisfaction.

As the Nigerian economy continues to expand and more people enter the formal banking sector, the demand for qualified tellers is set to increase.

In 2023, banks will require skilled individuals who can handle cash with accuracy, maintain confidentiality, and deliver exceptional service.

With a rapidly evolving digital landscape, banks are embracing innovative technologies.

However, the role of tellers remains irreplaceable, as face-to-face interactions and personalized assistance are still valued by customers.

The demand for tellers in 2023 will not only stem from traditional bank branches but also from mobile banking units and self-service kiosks.

Furthermore, bank teller positions offer attractive career prospects.

They provide opportunities for personal and professional growth, including training in financial management, customer relationship building, and banking regulations.

As the banking industry expands, tellers can expect competitive salaries, employee benefits, and advancement opportunities.

In the end, teller opportunities play a vital role in Nigeria’s banking sector, meeting the demands of customers and contributing to the overall economic development.

With the anticipated growth of the banking industry in 2023, the demand for skilled and competent tellers is expected to rise significantly, offering promising career prospects in the country.

Read: Customer Service as a Bank Teller in Nigeria: Tips

Key Factors to Consider for Teller Opportunities in Nigeria

Reputation and Stability of the Bank

Choosing a bank with a good reputation is essential when considering teller opportunities in Nigeria.

A bank’s reputation reflects its level of trustworthiness and credibility among customers and industry professionals.

A strong reputation can positively impact the working environment, customer base, and overall success of the bank.

A good reputation also attracts top talent, ensuring that the bank hires skilled and competent employees.

As a teller, working in a reputable bank can enhance your professional image and open doors to advanced career opportunities.

Banks with a positive reputation often have a solid customer base and a strong financial standing, providing stability and job security for employees.

Stability is another crucial factor to consider. A stable bank demonstrates resilience in the face of economic challenges and maintains a consistent level of profitability.

Choosing a bank with stability ensures that your career as a teller is not at risk due to unexpected financial downturns or organizational restructuring.

It provides a sense of security and fosters a positive work culture, which can significantly contribute to job satisfaction and personal growth.

Employee Benefits and Growth Opportunities

Top banks in Nigeria offer attractive employee benefit packages and excellent growth opportunities for their staff.

Employee benefits go beyond the basic salary and include various perks such as healthcare coverage, pension plans, paid time off, and bonuses.

These benefits can significantly contribute to the overall job satisfaction of tellers. In addition to benefits, growth opportunities are essential for career advancement.

Banks that invest in their employees’ professional development provide training programs, mentorship opportunities, and chances for internal promotions.

By choosing a bank that prioritizes staff growth, tellers can continuously enhance their skills, learn new technologies, and climb the career ladder within the organization.

Employee benefits and growth opportunities play a vital role in job satisfaction and overall performance.

These factors contribute to a positive work-life balance and ensure that tellers feel valued and motivated in their roles.

Additionally, banks that prioritize employee welfare often foster a collaborative and supportive work environment, enhancing productivity and customer service.

Technological Advancements for Efficient Transactions

Modern banking operations heavily rely on technology to facilitate efficient transactions and provide excellent customer service.

Banks leverage digital solutions, such as online banking platforms, mobile apps, and automated teller machines, to meet the increasing demands of customers for convenience and speed.

As a teller, it is essential to acquire skills in technological innovations to excel in your role and adapt to the changing landscape of banking.

This may include learning to operate various banking software, understanding cybersecurity protocols, and mastering customer relationship management systems.

Technological proficiency enables tellers to provide seamless and efficient services to customers, leading to enhanced customer satisfaction and loyalty.

The integration of technology in banking operations benefits both employees and customers. It improves transaction speed, reduces errors, and allows for easier access to financial information.

Customers can perform banking tasks anytime and anywhere, while tellers can focus on providing personalized assistance and advice.

In fact, when considering teller opportunities in Nigeria, it is crucial to evaluate key factors such as the reputation and stability of the bank, employee benefits and growth opportunities, and technological advancements.

Choosing a bank with a good reputation and stability provides a solid foundation for a long-term career.

Employee benefits and growth opportunities contribute to job satisfaction and personal development. Acquiring skills in technological advancements ensures efficiency and excellent customer service.

By considering these factors, individuals can make informed decisions and pursue successful careers as bank tellers in Nigeria.

Read: Case Study: A Day in the Life of a Nigerian Teller

Discover More: Challenges & Opportunities in Nigeria’s Banking Sector

Top Banks in Nigeria for Teller Opportunities in 2023

Access Bank

Access Bank is one of the leading banks in Nigeria, with a rich history and a stellar reputation. Founded in 1989, it has grown to become one of the largest financial institutions in the country.

Access Bank is known for its commitment to providing excellent services to its customers, and this extends to its employees as well.

One of the key advantages of working for Access Bank is the competitive employee benefits package it offers. From healthcare coverage to retirement plans, employees are well taken care of.

The bank also recognizes the importance of professional development and provides growth opportunities to help employees advance in their careers.

Another aspect that sets Access Bank apart is its investment in technological advancements.

As the banking industry continues to evolve, Access Bank understands the importance of staying ahead of the curve.

The bank has implemented cutting-edge technologies to enhance efficiency and improve customer satisfaction.

From mobile banking apps to digital payment platforms, Access Bank is at the forefront of innovation.

Zenith Bank

Zenith Bank is another top player in the Nigerian banking industry. Established in 1990, it has gained a solid reputation for its exceptional service and commitment to excellence.

Zenith Bank has consistently ranked among the top banks in the country and has won numerous awards for its outstanding performance.

Employees of Zenith Bank enjoy a wide range of benefits, including competitive salaries, health insurance, and generous retirement plans.

The bank also provides ample opportunities for personal and professional growth, with various training programs and career development initiatives in place.

Like Access Bank, Zenith Bank understands the importance of leveraging technology to enhance banking services.

The bank has heavily invested in digital platforms and online solutions to streamline transactions and provide customers with a seamless banking experience.

From internet banking to mobile apps, Zenith Bank has made significant strides in embracing technology.

First Bank of Nigeria

First Bank of Nigeria, founded in 1894, holds the distinction of being the oldest bank in Nigeria. Over the years, it has built a strong reputation for its reliability and stability.

The bank has played a significant role in the development of the Nigerian economy and continues to be a trusted financial institution.

Employees at First Bank of Nigeria enjoy a range of benefits, including medical coverage, retirement plans, and employee assistance programs.

The bank also provides opportunities for career growth through training programs, mentoring, and performance-based promotions.

First Bank of Nigeria recognizes the need to embrace technology to stay competitive in the modern banking landscape.

The bank has invested in digital banking solutions, including online banking platforms and mobile apps, to offer convenient services to its customers.

With a focus on innovation, First Bank of Nigeria aims to continuously enhance its technological capabilities.

In essence, Access Bank, Zenith Bank, and First Bank of Nigeria are among the top banks in Nigeria for teller opportunities in 2023.

These banks offer competitive employee benefits, growth opportunities, and have made significant investments in technological advancements.

Working for any of these banks can provide individuals with a promising career path in the banking industry.

Read: Interview Tips for Bank Teller Positions in Nigeria

Steps to Prepare for Teller Opportunities in 2023

Preparing for teller opportunities in Nigeria’s top banks in 2023 requires a strategic approach to enhance banking skills, improve technological proficiency, and build a strong resume and cover letter.

Enhancing Banking Skills

Enhancing banking skills is the foundational step in preparing for teller roles. Acquiring relevant banking knowledge and skills demonstrates competence and professionalism.

Individuals can consider enrolling in banking courses, attending industry seminars, and participating in workshops to improve their banking skills.

These practical approaches provide knowledge about various banking operations, customer service, and financial products.

In addition, individuals can gain insights from experienced professionals and network with industry experts at these events.

Read: Top Banking and Finance Certifications in Nigeria

Improving Technological Proficiency

Furthermore, improving technological proficiency is essential for teller positions in the modern banking landscape.

Technological knowledge enables tellers to efficiently process transactions, handle digital banking platforms, and address customer queries.

Online tutorials, industry publications, and specialized training programs can be valuable resources to enhance technological proficiency.

These resources offer guidance on using banking software, understanding digital payment systems, and leveraging technological tools for effective customer service.

Staying up to date with the latest technology trends in the banking industry is crucial for tellers to succeed.

Building a Strong Resume and Cover Letter

Building a strong resume tailored to teller opportunities is another significant step in securing a role in Nigeria’s top banks in 2023.

A well-crafted resume should showcase relevant skills, experience, and educational background.

It is essential to highlight skills such as cash handling, attention to detail, customer service, and proficiency in banking software.

Additionally, including any certifications or continuing education related to banking on the resume can enhance credibility.

Publish Your Professional Profile, Business or Brand

Showcase your expertise, gain trust, and boost visibility instantly on Professions.ng.

Publish NowMoreover, individuals should emphasize achievements and quantifiable results to demonstrate their suitability for teller roles.

Writing a compelling cover letter is equally important in the application process.

The cover letter should be customized for each bank and teller position, highlighting the applicant’s enthusiasm, relevant skills, and experience.

It is an opportunity to express passion for the banking industry and specific bank.

Additionally, incorporating specific achievements or experiences that align with the bank’s values or goals can make the cover letter more impactful.

Proper formatting, grammar, and attention to detail are essential to create a professional impression.

In a nutshell, preparing for teller opportunities in Nigeria’s top banks in 2023 requires individuals to enhance their banking skills, improve technological proficiency, and build a strong resume and cover letter.

By prioritizing these steps and following practical guidelines, aspiring tellers can increase their chances of success in acquiring teller roles in Nigeria’s banking industry.

Read: The Future of Bank Teller Jobs in Nigeria: Analysis

Conclusion

Teller opportunities in Nigeria’s banking sector play a vital role in the country’s economic growth and development.

By offering job opportunities to individuals, these banks provide a platform for career growth and advancement.

It is highly recommended that aspiring individuals consider the top banks highlighted in this blog chapter as a pathway to future career prospects.

These banks, such as Access Bank, First Bank, and Zenith Bank, have a strong reputation and offer excellent training and development programs.

Furthermore, working as a teller in these top banks not only provides a stable income but also allows individuals to gain valuable experience and skills in financial services.

This job position also offers opportunities for career advancement within the banking sector.

Therefore, if you are considering a career in the banking industry and are interested in teller opportunities, it is advised to explore the possibilities offered by the top banks mentioned.

By doing so, you will be setting yourself on a path towards a successful and fulfilling career.